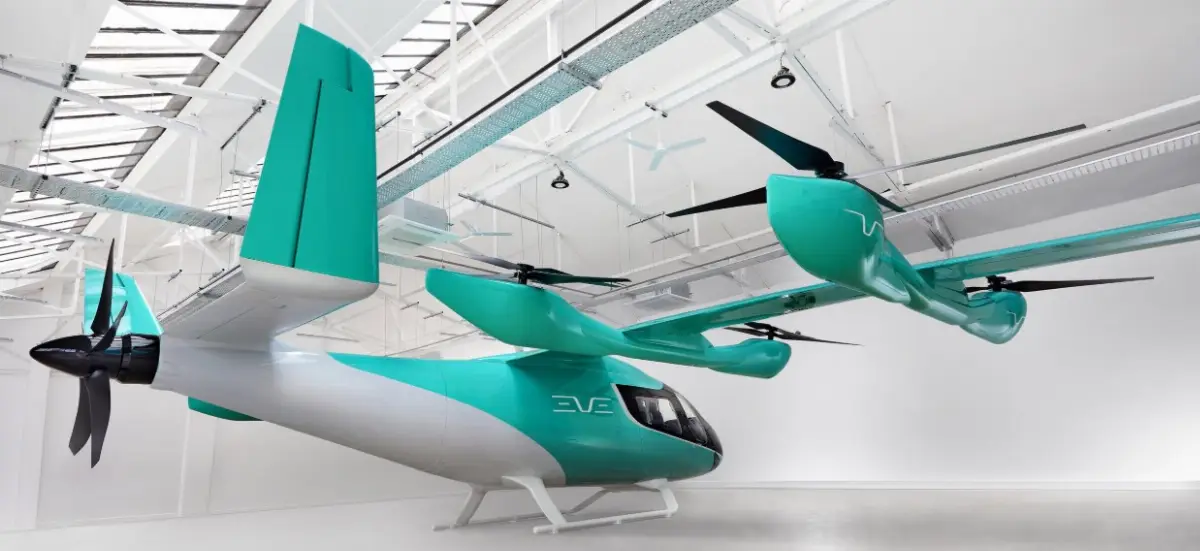

Eve Air Mobility secures $150 million financing to sccelerate eVTOL fevelopment

For R&D, certification, vertiports and UTM systems for commercial UAM

Eve Air Mobility (“Eve”), a global reference in the development of next-generation electric vertical take-off and landing (eVTOL) solutions, has secured $150 million in debt financing from a syndicate of leading financial institutions. The 5-year loan included Itau, Banco do Brasil, Citibank, and Mitsubishi UFJ Financial Group, underscoring strong market confidence in Eve’s vision and long-term strategy.

The proceeds will support Eve’s Research and Development, including the integration of its eVTOL aircraft into a comprehensive Urban Air Mobility (UAM) ecosystem. This funding accelerates technological progress and strengthens partnerships with infrastructure providers and regulatory bodies. With these resources, the Company can advance aircraft certification and commercialization while ensuring compliance with global aviation standards. This transaction enhances Eve’s capacity to meet rising global demand for sustainable, low-emission transportation and enables scalable operations in key urban markets.

With this transaction, Eve’s total funding now reaches $1.2 billion, reaffirming its status as one of the best-capitalized companies in the emerging eVTOL market.

The Company recently completed the first flight of its full-scale engineering prototype at Embraer’s test facility in Brazil, marking a critical step toward commercialization. This successful hover validates key systems, including fly-by-wire controls and energy management, and initiates a robust test campaign planned for 2026.

AVIONEWS - World Aeronautical Press Agency